Date posted: 2022-01-20

As a company director, you’ve been working hard on your business day and night and now it’s starting to pay off. The business actually has money in the bank and you’re starting to turn a profit. You’re winning!

But you set up a limited company, so the company money is separate to your own personal finances. So how do you get cash out of the business and into your pocket? In this blog post we take a look at the options for paying company directors.

Some of the key questions we regularly get asked from company directors is “how do I pay myself?” or “how much can I pay myself?” This might seem strange, but the answer isn’t always straightforward! You’re both an employee and a director at the same time, so how does it work? There’s pay-as-you-earn (PAYE), dividends, tax, pensions, benefit-in-kind payments to think about. Where do we start?

Tax on Directors Pay

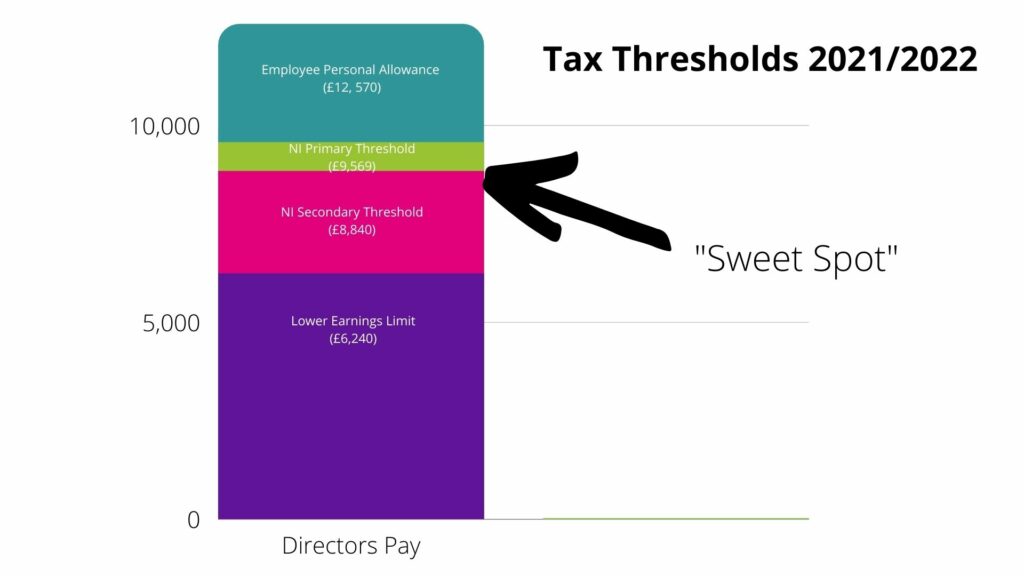

Usually, the most tax-efficient way to pay company directors is a combination of PAYE and dividends. Many directors pay themselves a relatively low salary through the normal payroll channels. There are a few tax thresholds that you need to be aware of:

- Personal Tax Allowance. You have an allowance (which is currently £12,570 per year) that you don’t have to pay income tax on. So it’s best to keep your directors pay below this to begin with.

- National Insurance (NI) Primary Threshold. Above this amount you’ll have to pay employee’s NI contributions.

- National Insurance (NI) NI Secondary Threshold. This is the amount you can earn before you have to pay employer’s NI contributions. Since you’re the company director, this is important too!

- Lower Earnings Limit. This is the minimum amount you have to earn to qualify for a state pension when you reach retirement age. You probably want to stay above this figure.

So your best bet, to avoid income tax and stay above the lower earnings limit, is to go for the “sweet spot” between the Lower Earnings Limit and Secondary NI Threshold. For this tax year (2021/2022) you’d be looking at £8,840 as an annual salary.

Employment Allowance

As long as you’re not the sole employee of your company, you could be eligible to claim employment allowance. This gives you up to £4,000 back from your Employers NIC liability. You can bump up your pay to £12,570 (the personal tax allowance threshold) and still pay minimal taxes. You will have to pay employee’s NI contributions, but the employers NI contributions will be refunded through the Employment Allowance scheme.

Because corporation tax is calculated after salaries and NI contributions are taken off, you’d also save on this by paying yourself that little bit more!

Directors Pay through Dividends

You also have a tax-free dividend allowance of up to £2,000. Dividends can only be paid to shareholders if the company has made a profit. And the value of the dividend is taken from the profits after corporation tax is applied.

Anything above the initial £2,000 dividend allowance is taxed at a lower rate compared to your salary, but you have already paid corporation tax on it.

Time to talk it through?

Phew! There’s a lot to think about. Particularly if you need to take a reasonable salary to live the life you want. There are other things we can look at with regards to your personal tax that might help you to get more from your business in a tax-efficient way.

If you’d like to discuss your payroll situation, tax affairs or paying company directors, get in touch with a member of our team. We can talk you through your options and figure out a salary and dividend package that works for you. Drop us an email using the contact form below or give us a call on 01484 600514. We’d love to hear from you.