Date posted: 2020-06-22

We’re going to take a look at how you as a business owner can make the most of the “new normal” – by looking at allowable expenses for employees.

During the COVID-19 pandemic we’ve seen so many things change. From the way we do business, to the way we do our supermarket shop. We still don’t know what the future will hold. But we do know that, for some, going into the office everyday might become a thing of the past!

What do we mean by “allowable expenses”?

Allowable expenses are anything that you need to buy to keep your business running. Basically this is anything and everything that you buy for the business; from insurance to stationary. All of these purchases are deducted from your net profit before we calculate your corporation tax.

In our pre-lockdown world, employees would claim expenses for things like mileage or hotels and accommodation when working away. You would pay for what you need up front and submit your receipts to your employer (or use software to do it – have we mentioned ReceiptBank?). The business can then reimburse you for what you’ve spent without you paying income tax on it.

So what can we allow for employees working from home?

Now that the majority of the workforce is working from home travel expenses don’t really apply. But we do need to think about keeping our employees happy!

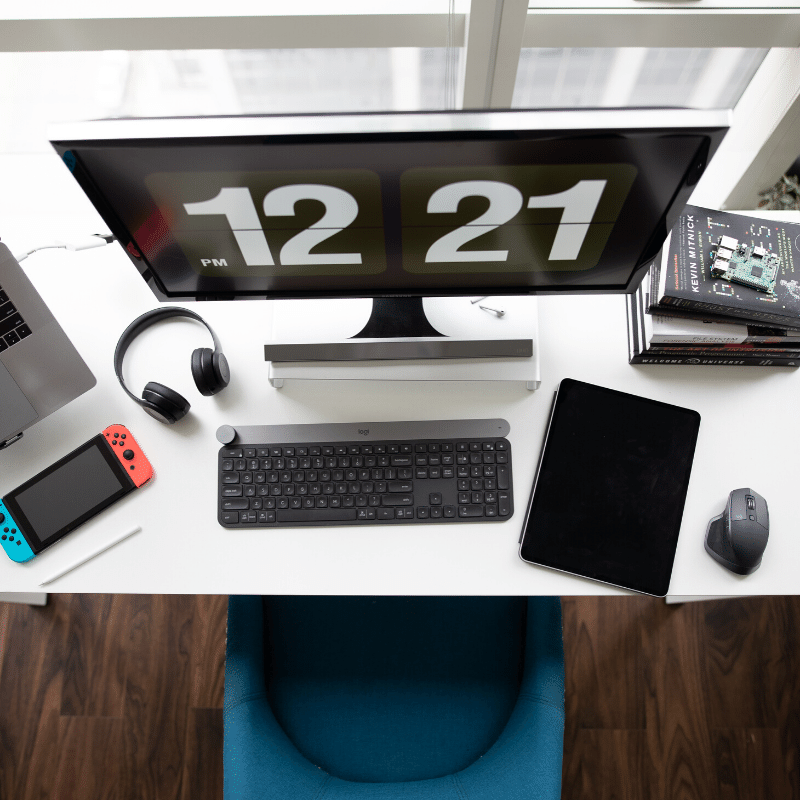

This means making sure they have the right equipment to do their job. This might be desks, chairs and display screen equipment. It might be additional IT equipment such as laptops, screens, keyboards etc.. You still have a responsibility to your staff to make sure they’re working in a comfortable, productive environment.

So you can provide them with office equipment, as long as they’re using it for work (and personal use is “insignificant”). Normally this would be seen as a “benefit-in-kind” (and you’d still have to pay tax and NI) but under the coronavirus legislation they can reimburse you in full.

From what we’ve seen so far (with regards to IT equipment in particular) – your best bet is to let each member of staff collect the equipment they need from the office. You don’t need to go out and buy everybody a fancy new laptop!

Household expenses

You can also claim £6/week (or £26/month) for household expenses. This goes out on their payroll just like any other employee expense and is not subject to income tax. You might be able to claim a bit more, but you’ll have to report it in a more detailed way, demonstrating your increased costs as a result of working from home.

You can’t claim for things that they would have paid for anyway; things like a broadband connection, rent/mortgage payments, etc. The idea of the payments is that they cover heating, lighting and bills that would be cheaper if you weren’t working from home.

What should we do next?

If you’re an existing payroll client of ours, give us a call and we’ll get you set up. Otherwise, those of you who submit payroll through HMRC’s online portal can do it through there.

If you have any questions about what you can claim as expenses, speak to a member of our team today!