Date posted: 2021-12-09

Creating, owning and running a business can be a huge part of your life. For many business owners, working forever is not the goal. Getting out of the business with enough funds to live the life you want is often what we strive for. Employee Ownership Trusts are an alternative to selling your business, providing a tax-efficient, flexible exit plan.

What is an Employee Ownership Trust?

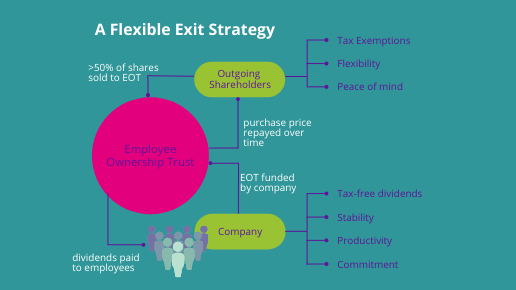

Employee Ownership Trusts were introduced by the UK Government in September 2014. In this business model, a trust is set up for the benefit of the employees. This trust then goes on to purchase a majority shareholding in the company. As the business continues to make a profit, the trust will repay the purchase fee to the original owners, and will eventually pay dividends to employees.

There are plenty of examples of businesses who operate as an Employee Ownership Trust, from travel agencies to manufacturing companies. Retailer John Lewis has been operating under this model since 1929, long before the government introduced tax incentives for outgoing business owners.

What are the benefits?

There are a number of reasons that Employee Ownership Trusts are on the increase across the UK. The benefits include:

Tax relief

Tax relief for outgoing shareholders using an EOT model means limited tax liabilities. If over 50% of business is sold to the Trust, the previous owners are exempt from capital gains, income and inheritance tax on their earnings.

There are also tax benefits for the new shareholders, the employees. Every year, employees can receive up to £3,600 each, which is not subject to income tax.

Flexibility and stability

For many business owners, selling your business is a decision that you agonise over for a long time. With an Employee Ownership Trust, you could retain a stake in your business if you wish. You could even continue working for the company, drawing a salary and phasing out your input over time.

EOTs offer considerable stability in comparison to selling to a competitor or larger organisation, particularly if your management team aren’t in a position to purchase the company. Your business can continue to operate as before, retaining your existing employees and client-base. This can help with the “guilt” of selling, and give you confidence that your staff will be looked after when you’re no longer working there.

Culture and commitment

Implementing an Employee Ownership Trust model can have a positive impact on company culture. In fact, many EOT-owned companies go on to be even more successful, profitable and competitive in their market. Providing employees with a stake in the business can increase productivity and reduce absenteeism. Each employee will have equal ownership through the trust, boosting engagement and encouraging commitment to the company’s success.

Once the trust is set up, trustee directors are appointed. These can be outgoing shareholders, independent parties or employees from within the company. Many companies establish a democratic process where elections are held for employees to appoint trustees. This can also have positive implications on company culture, with staff members feeling more involved with extra responsibility alongside their shared ownership and dividends.

How does it work?

Setting up the trust and sale of the company is a fairly straightforward process. But it is essentially an acquisition so will require legal documentation and accountancy specialists to value the company. Depending on the size and complexity of the company, the costs associated with legal advice, documentation and valuation can be as little as £20,000. The whole process can be carried out within a relatively short time-frame if required; within just six weeks.

For more information about employee ownership trusts and other options for exit strategies, book an appointment to run through your options with a member of our team. We work closely with the commercial team at Leonard Curtis Legal, who can assist with the legal formalities of selling your business. Our staff are always on hand to help you with business strategy and tax planning, get in touch today.