Date posted: 2021-02-17

One of the questions we’re asked regularly is, “What can I take out of my business?” Closely followed by, “How do I save more tax?”. We’ve summarised some of the key tax benefits in this blog post.

There are some aspects of running your business where you’ve probably already considered the tax implications. You’ve probably thought about how much to pay yourself in salaries and dividends. You might have employed your partner or spouse, or given shares to family members. We all want to be sure we’re paying the right amount of tax; both personally and as a business.

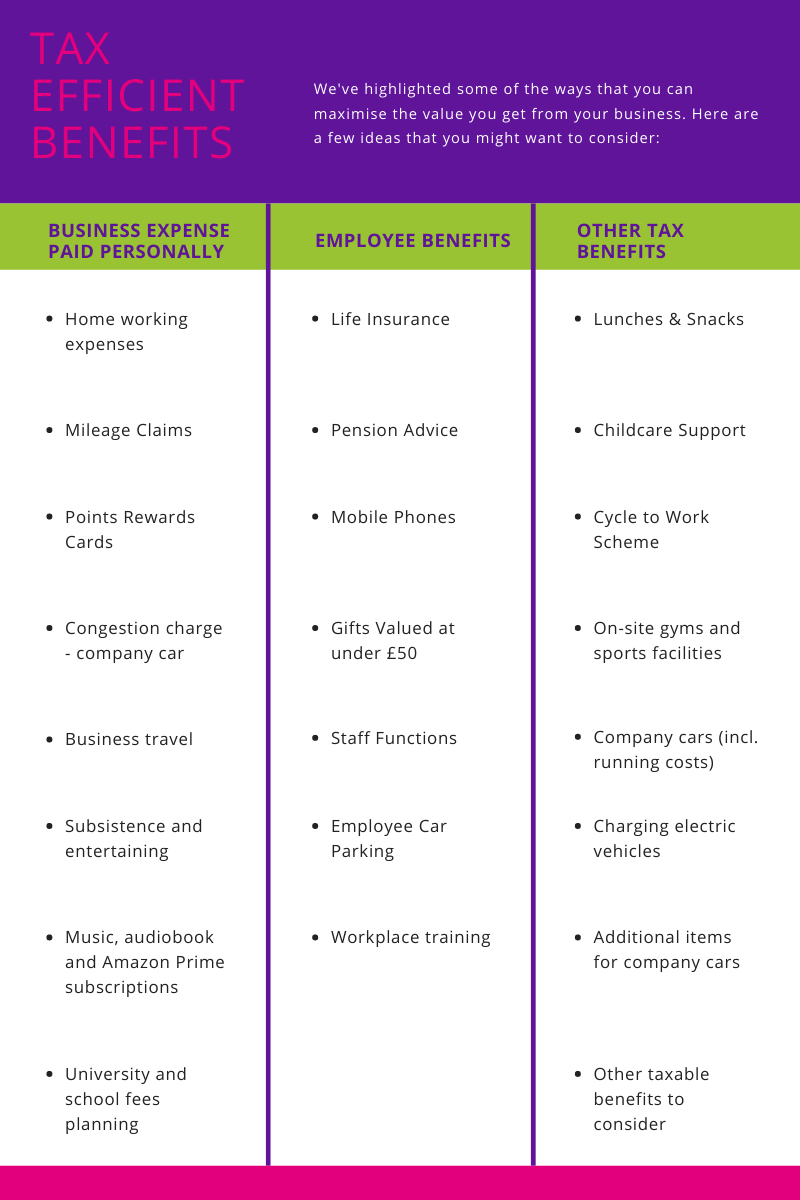

There are also things like registered pension schemes, rent, and making personal use of company assets. But what about some of the “lesser used” tax benefits? Have a look at the table below. Are you using these tax benefits to your advantage?

In all honesty, these might not necessarily be relevant to your business. One of the key benefits to look at in the current climate is home working expenses. Over the past year we’ve seen a dramatic shift towards people working from home – but not all businesses are taking advantage of the allowances.

Carrying out a Tax Benefits Review

At My Management Accountant, we want you to maximise every opportunity to make tax efficient savings. We can carry out a Tax Diagnostic Review to look into your business and personal circumstances to ensure that you have everything in place to take advantage of these tax savings. We have an in-house client tax specialist who can talk you through your options and come up with a tax strategy that works for you.

Every business owner can maximise the value they get from their business; for themselves, their families and their employees. You just need a strategy.

Get a quote for A Tax Diagnostic

Let’s have a chat

If you’d like to find out more about our tax services, and how we can help you, get in touch. Our friendly team are on hand to answer your tax-related queries.