"The furlough scheme has undoubtably helped to minimise redundancies. But I think it could have been sector specific, particularly when the flexi-furlough scheme was introduced" - Martin Bown

Date posted: 2021-11-11

As the UK’s furlough scheme (Coronavirus Job Retention Scheme or CJRS) comes to an end, we look at how successful it’s been and how it’s helped some of our clients to keep their businesses going.

Rewind to February 2020 and most of us had never heard the word “furlough” before. To take the Google definition, it relates to a (temporary, paid) leave of absence from work. The term was previously used to describe military personnel or missionaries returning from overseas on leave. The word itself comes from the German verlaub, which means “to leave”.

When the Covid-19 pandemic hit, the UK government had to act quickly to protect jobs and the economy. Under the furlough scheme, employees who could not work due to lockdown restrictions could remain on payroll. Rather than making staff redundant, businesses were given grants to cover up to 80% of an individual’s salary.

The scheme was introduced by Rishi Sunak in March 2020 and was projected to last just 3 months. Furlough finally came to an end on 30th September 2021. But how much of an impact has it had?

The initial response to the pandemic

In March 2020, when the government introduced lockdown restrictions, we had many conversations with all of our clients. Most felt disbelief at the prospect that the businesses they’d spent years building were under threat from an almost unimaginable scenario. Business owners, who felt loyal to their teams, faced an impossible decision; deciding who they could let go.

At the time, our advice was to sit tight. Wait. See what the government would do to help. We knew that those in charge would not want to face mass redundancies and the potential for long-term unemployment on a huge scale. When the furlough scheme was announced, we talked it through with our payroll clients. In most cases there was a feeling of immediate relief, some tears, and momentary celebration. There was hope for all of our clients’ businesses.

As a team, we felt that communicating with our clients was really important at this time. We sent out regular emails with information on the business support packages available. We also set up weekly online meetings that were effectively drop-in sessions for our clients who needed advice, to speak to other business owners and share experiences, or just express their concerns. The virtual sessions were well attended and those who came found them really positive and beneficial.

Setting up furlough

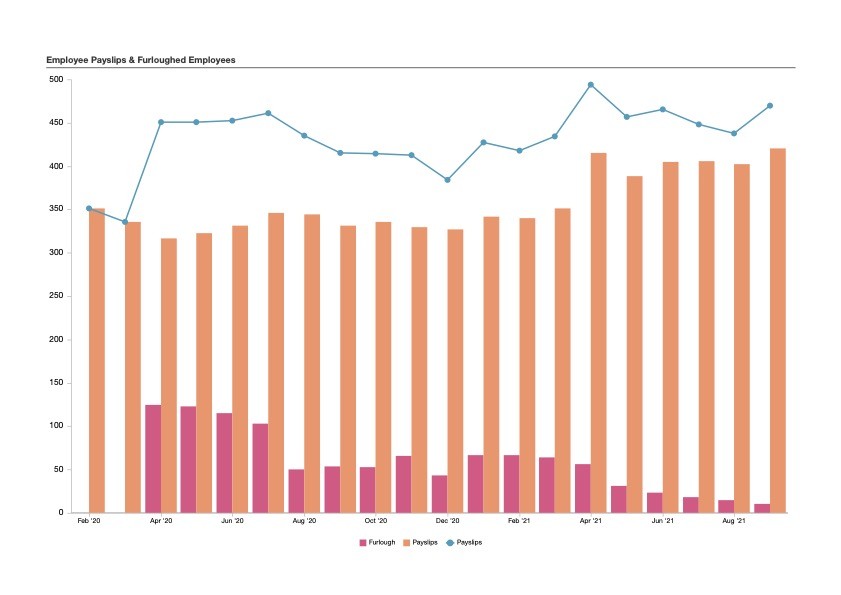

Initially, we set up an online form to collect information from our payroll clients as to who they were putting on furlough. We spent the first month (April 2020) processing and submitting claims, including backdated claims for March 2020. At this point, 39.4% of employees across all of our payroll clients were placed on furlough.

In effect, our payroll workload increased from processing around 320 payslips per month, to over 450. We submitted the furlough claims online through the HMRC portal. But our payroll team also had to phone HMRC regularly on behalf of our clients due to technical issues with the online system. At this point, we didn’t charge our clients for the additional work for furlough claims. We just wanted to ensure that they received the funds they needed to keep their businesses afloat and look after their staff.

By July 2020, our clients’s furlough claims were at 29.8% of payroll employees. From here we started to see a further decline in the number of employees furloughed. This was partly down to restrictions lifting, and careful planning by our clients as they found ways to bring their employees back to work safely.

With the introduction of additional lockdown restrictions in January 2021, we saw another increase in furloughed employees. This started to decline in March, and continued to drop until the scheme closed at the end of September 2021.

Has it helped?

The Coronavirus Job Retention Scheme appears to have been a success. Despite the £70 billion price tag, we’ve seen fewer redundancies than expected and unemployment figures are better than during the last recession (2008-2011). Nationwide, the government estimates that this scheme has supported 11.6 million jobs. And data from October 2021 shows that the labour market is continuing to recover, with unemployment figures returning to pre-pandemic levels.

We’re really glad that the furlough scheme has ended, and our payroll team are looking forward to focussing on producing standard payslips and growing our payroll service in a more positive way. The end of furlough also signifies a big step forward in our economic recovery from the coronavirus pandemic, for local businesses and the country as a whole.

For more information on the payroll services that we offer, get in touch with our team. We’re also available to discuss any other advice that you might need in the wake of lockdown restrictions and returning to work as “normal”.