Let's be clear on tax - we value transparency and want to build trust with our clients

Date posted: 2021-02-08

When it comes to tax advice, there’s an awful lot to think about. As a business owner it can seem daunting to think about both your personal and business tax affairs. And you need somebody to talk to that you can trust.

We often see a lack of transparency when it comes to tax advice; which means that, as a business owner:

- you don’t know what to expect from your accountant

- you don’t know if you’re getting the advice that you need

We want to change that.

Tax advice is a complex area of accounting that is quite different from what we would call “the basics”. For a service like bookkeeping, for example; it’s a well-defined service and (relatively) easy to provide. When you enquire about bookkeeping services, we’ll ask you a series of questions about your business, and send you a quote based on how much work it requires on our part.

Tax advice shouldn’t really be any different. But it often is…

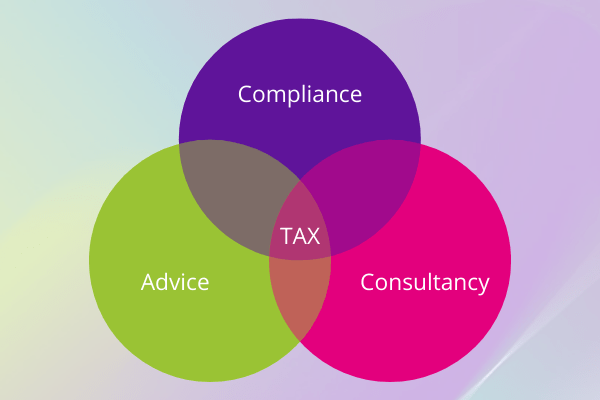

Three types of tax services

We recently took on a new Client Tax Advice Manager; Loubie. Having a tax specialist on the team has made us look at the different areas of tax advice that we provide. We want to be really transparent about the types of tax advice that we offer, so we’ve broken it down into three key areas:

Tax compliance

Helping you to pay the correct amount of tax that’s due; your year end accounts and tax returns.

Tax advice

Project-based work designed to improve your business’s position when it comes to tax. We aim to allow you to make future savings or get cash back into your business. This might be through an R&D tax claim, for example.

Tax consultancy

Taxing a holistic view on your tax situation. We look at where you’re at now, and where you want to be moving forward. We apply our knowledge of the tax legislation to avoid any future pitfalls and plan for your future – on both a business and personal level.

Many accountancy firms will have a tax compliance service that’s priced or built into their accountancy packages; with tax solutions delivered and charged for as and when the need arises.

Tax consultancy though? That’s a bit more difficult to price for.

Our Tax Services

At My Management Accountant we pride ourselves on being transparent and open with our clients. We recognise that different businesses have very different requirements in terms of tax. At each stage of a business’s lifecycle, there are different tax service options to consider, to make sure you’re paying the most efficient amount of tax:

Early stage start-up business

STARTER PLANNING

Ensuring the right split between salaries and dividends. Our standard level for tax consultancy is that we do salary and dividends planning; we calculate the perfect split so that you get paid in the right way.

Small, stable business

EXTRACTING VALUE

Exploring the different ways to tax-efficiently put things through the business or take value out of the business to benefit yourself as a business owner

A growing business

TAX DIAGNOSTIC

As the business grows, the director shareholders can look to maximise their takings, invest in the business and want to mitigate chargeable profits to corporation tax.

An expanding business

BUSINESS STRUCTURE

The business may now be disposing of assets and reinvesting to expand. Likewise, the structure of the business may need to be considered to better facilitate expansion – whether in the UK or overseas.

A concluding business

END-GAME TAX PLANNING

Around 3+ years in advance of implementing your “escape” – it’s worth thinking about the tax implications of selling your business.

This is the full 360 review!

With Loubie joining the team as our Client Tax Specialist, we’re renewing our focus on helping clients with tax savings. We want to help you to feel confident that you’re paying the right amount of tax. Our tax consultancy services tie in with our business planning services; helping you push your business to the next level.

For more information on how we can help you with tax advice, get in touch with our team. We’re always happy to help and we can talk through your specific set of circumstances in detail.