Date posted: 2020-10-29

EDIT: No sooner have we published our post about the job support scheme, the government hold a press conference! The UK is back in lockdown and there are significant changes to the economic support packages on offer.

Coronavirus cases are back on the increase across the UK, so the government have introduced a second (more lenient) lockdown. This means that they’ve also changed the financial support available to both businesses and individuals. As of last week, (5th November 2020), this information is up to date:

Changes to support packages:

- The Job Support Scheme (detailed below) has now been withdrawn.

- The furlough scheme has been extended to the end of March 2021. Workers on furlough will continue to receive 80% of their salary, but employers will have to contribute to NI and pension schemes.

- The Self-Employed Income Support Scheme (SEISS) will be increased from 55% of average trading profits to 80%. This will apply to the period covering November to January and will be capped at £7,500.

- CBILS and BBL schemes will also be extended.

We’ll update you with further information as soon as we get it – the economic landscape is changing so quickly at the moment!

As always, if you have any questions about payroll, furlough or securing funding; get in touch with the team.

In the recently announced Winter Economy Plan, Rishi Sunak unveiled a new package of job support measures. The Chancellor aims to help businesses in their Covid-19 recovery and help get the UK back to work.

The package includes a range of measures, focused around the new Job Support Scheme. This new scheme will replace the original Job Retention Scheme (furlough), which ends on the 31st October. The idea is to keep as many people as possible in employment over the winter months.

The government made some last minute changes to the scheme last week; reducing the number of hours required for employees to be eligible and also reducing the employer contribution to their wages.

The Job Support Scheme (JSS) is split into two broad categories:

Job Support Scheme (JSS) Open

Many businesses across the country are able to operate safely under social distancing guidelines. However, you might be experiencing a drop in demand for your products or services. The JSS Open scheme is for companies that are open for business, but don’t have enough work to keep all of their staff.

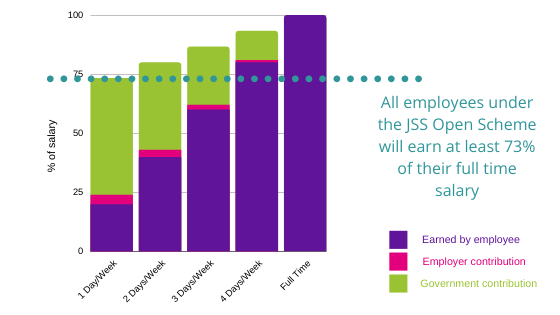

You can apply for the scheme for any employee that is working at least 20% of their contracted hours. For the hours not worked the government and employer will contribute towards topping up the salary. The employer will pay just 5% of the salary for those hours, and the government will top this up to two-thirds of the employee’s salary.

This means that everybody under the scheme will get at least 73% of their normal take-home salary. The graph below demonstrates how this changes depending on how many hours you work (based on working a 5-day week):

The government contribution is capped at £1,541.75 per month. So anybody who earns less than £3125/month will receive a minimum of 73% of their monthly wage. Despite significantly reduced working hours!

This scheme will be open to all SMEs across the UK, even if they have not previously benefitted from the Job Retention Scheme. You’ll also be eligible to claim the Job Retention Bonus from early next year. That’s £1000 per employee for everybody who was furloughed and still employed by 31st January 2021.

More information about the JSS Open Scheme is available on the government website.

Job Support Scheme (JSS) Closed

A number of business are still required to close completely due to the coronavirus pandemic. These businesses will be supported by the JSS Closed scheme.

Each employee will be given two-thirds of their normal salary, up to a maximum of £2,083.33 per month. The government will fully fund this but you have the option to top-up employees pay, just like with the previous furlough scheme.

For employees who fall into this category, it might also be worth looking into Universal Credit.

Support for the self-employed

In addition to the new Job Support Scheme, the Chancellor has announced additional help for the self-employed. The Self Employment Income Support Scheme (SEISS) has been extended until April 2021.

The scheme has the same eligibility criteria as the previous SEISS scheme. Payments will be split in two; one covering November 2020 to January 2021, and the second covering February to April 2021. The government will pay a taxable grant up to 40% of average monthly trading profits for the 3-month period. This is capped at a maximum of £3,750.

Like the Job Support Scheme, the SEISS aims to help people who are facing reduced demand for their products or services due to COVID-19 restrictions. It also applies to individuals who have had to stop trading altogether due to the pandemic.

Pay As You Grow Loans

The Chancellor announced changes to the original loan schemes to further help businesses in the winter months:

• Bounce Back Loans (BBLs)

Bounce Back Loans can now be repaid on a ‘Pay As You Grow’ basis. The repayment period has been extended from six years to ten. For many businesses this will dramatically reduce monthly repayments.

You can now choose to repay on an interest-only basis. And there’s the option to suspend repayments if your business is struggling.

• Coronavirus Business Interruption Loans (CBILs)

The deadline for Coronavirus Business Interruption Loan applications has been extended to 31 December 2020. This means you can still apply – we’re helping clients with their applications and we’ve had much more success than when the loans were first introduced.

Tax cuts and deferrals

• Deferred Tax

Deferred VAT from Q2 2020 (that was due to be paid in March 2021 in a lump sum) can now be repaid over 11 interest-free instalments. However, you’ll need to apply for this method of repayment, it is not automatically applied.

Tax liabilities owed by the self-employed can now also be spread over 12 instalments.

• Hospitality/tourism VAT

The temporary reduction in the VAT rate to 5% has now been extended to from the 13 January 2021 until 31 March 2021 to further support the hospitality and tourism sectors.

A complete overview of the winter economy plan is available on the government website.

At My Management Accountant we always try to keep our clients and friends up-to-date with changes to the accountancy landscape. We’re here to help support your business in these challenging times. If we can be of assistance, or if you have any questions, please don’t hesitate to get in touch with a member of our team.